The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities. KNOXVILLE, Tenn. & TEMPE, Ariz.–(BUSINESS WIRE)– #AmericanSolar–The Tennessee Valley Authority (TVA) today announced that it has secured 279 megawatts (MWDC) of advanced thin film solar panels from… First Solar CEO Mark Widmar joins ‘Squawk on the Street’ to discuss the company’s expansion plans, weak demand in other parts of the solar industry, and more. First Solar said on Thursday it has selected Louisiana to build its fifth U.S. factory amid a surge in demand for American-made solar panels.

The factors driving First Solar’s valuation include its strong track record of financial performance, innovative PV technology, and its position as a market leader in the solar energy industry. The increasing demand for clean and sustainable energy solutions has fueled investor interest in First Solar, as the company is well-positioned to capitalize on the global shift towards renewable energy. The renewable energy industry, particularly the solar energy sector, has grown significantly in recent years. The increasing global focus on reducing carbon emissions and combating climate change has propelled the adoption of renewable energy sources, including solar power. First Solar operates in a highly competitive market alongside other solar energy companies. First Solar’s stock performance has been impressive in recent years, reflecting its solid financial results and positive market sentiment.

The largest electric utility holding firm, NEE reported impressive financials in the recent quarter. It saw a 100% jump in net income to reach $2.8 billion and the net income in the renewable energy sector increased by over 10 times. The company also added 1,665 megawatts of new renewables and projects to the backlog. https://1investing.in/ Dividend yield allows investors, particularly those interested in dividend-paying stocks,

to compare the relationship between a stock’s price and how it rewards stockholders through dividends. The formula for calculating dividend yield is to divide the annual dividend paid per share by the stock price.

The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season. As an investor, you want to buy stocks with the highest probability of success. That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style. FSLR, +0.70% were moving more than 6% higher in Thursday’s aftermarket action after the solar-technology company easily cleared expectations with its second-quarter results…. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams.

First Solar raised at BMO after post-analyst day pullback

And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data. Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. First Solar experienced a decline in its earnings at a rate of 32.7% per year on average, according to Simply Wall St. The semiconductor industry’s average annual earnings growth is 31.4%. Therefore, First Solar earnings are slightly higher than the industry average. After, a positive return the stock invited profit booking, and the price still declined from the trendline showing that the selling strength is tremendous and pointing to more upcoming falls on the charts.

Some of First Solar’s key customers include major utilities, such as Southern Company, Dominion Energy, and NRG Energy. First Solar, Inc. is a solar technology company, which engages in the provision of solar modules. It is involved in the design, manufacture, and sale of cadmium tellurid (CdTe) solar modules, which convert sunlight into electricity.

About First Solar (NASDAQ:FSLR) Stock

First Solar has maintained a healthy balance sheet, with enough assets to cover long-term debt. The company’s debt levels have remained relatively stable, allowing it to invest in research and development, expand production capacity and pursue strategic initiatives. Zacks Earnings ESP (Expected Surprise Prediction) looks to find companies that have recently seen positive earnings estimate revision activity.

An industry with a larger percentage of Zacks Rank #1’s and #2’s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4’s and #5’s. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Quarterly earnings reports are continuing to roll in for the S&P 500 — but earnings season never really ends, because about 20% of companies in the benchmark index have fiscal quarters that don’t matc… Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index (Market Barometer) quotes are real-time.

- First Solar’s stock performance has been impressive in recent years, reflecting its solid financial results and positive market sentiment.

- First Solar CEO Mark Widmar joins ‘Squawk on the Street’ to discuss the company’s expansion plans, weak demand in other parts of the solar industry, and more.

- Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations.

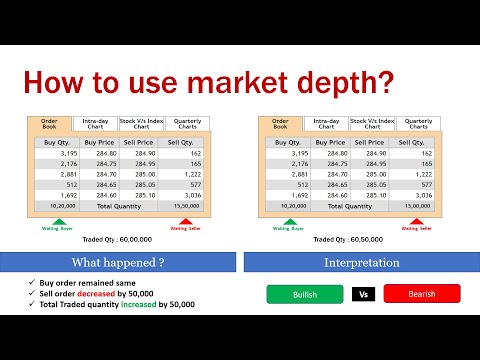

A record amount of solar panels are expected to be installed in the U.S. this year, but the fate of companies in the industry has diverged. FSLR’s beta can be found in Trading Information at the top of this page. A stock’s beta measures how closely tied its price movements have been to the performance of the overall market. The MACD line at 3.98 and signal line at 3.59 are below the zero line and both lines have crossed each other multiple times but the gap is lean in a histogram showing traits of consolidation in price. Solar power still accounts for a very small percentage of the electricity generation across the world and this means there will be a significant rise in demand in the coming years. First Solar has already established itself in the industry and is one of the top players today.

The transition towards solar energy has only started gaining momentum and there is a lot more to come. While the stock isn’t cheap, there is a lot of upside from the current level. It also has a cash balance of $1.5 billion which can allow the company to invest towards expansion purposes. According to 27 analysts, the average rating for FSLR stock is “Buy.” The 12-month stock price forecast is $234.06, which is an increase of 33.98% from the latest price. Another challenge is the intense competition within the solar energy market. Rapid technological advancements, the emergence of new market entrants, and fluctuating pricing dynamics pose risks to First Solar’s market share and profitability.

Compare

FSLR’s historical performance

against its industry peers and the overall market. Morningstar analysts hand-select direct competitors or comparable companies to

provide context on the strength and durability of FSLR’s

competitive advantage. The 14 SMA is below the median line at 43.23 points which indicates that the FSLR stock is in a bearish territory and both lines are moving closely. However, if it maintains the current level, the FSLR price could continue to move upward and reach the first and second resistances of $183 and $193.

First Solar recently commenced production at its manufacturing plant in India. Please note that all recommendations are based on our model’s results and do not represent our personal opinion. Sign-up to receive the latest news and ratings for First Solar and its competitors with MarketBeat’s FREE daily newsletter. The industry with the best average Zacks Rank would be considered the top industry (1 out of 265), which would place it in the top 1% of Zacks Ranked Industries. The industry with the worst average Zacks Rank (265 out of 265) would place in the bottom 1%.

Kroger Stock, Intuit, Danaher, and More to Watch This Week

These returns cover a period from January 1, 1988 through July 31, 2023. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations.

One significant growth opportunity for the company is the advancement of solar energy in emerging markets. As developing countries seek to diversify their energy sources and achieve energy independence, First Solar can leverage its expertise and global presence to provide cost-effective and sales service meaning reliable solar solutions. First Solar’s valuation metrics reflect its strong market position and growth potential. The company’s price-to-earnings is slightly above the industry average, indicating that investors are willing to pay a premium for First Solar’s earnings compared to its peers.

First Solar (FSLR)

The company’s product portfolio includes a range of high-performance PV modules, advanced PV power systems, and comprehensive PV power plant services. First Solar’s modules are known for superior energy efficiency, durability, and low environmental impact. These attributes have attracted diverse customers, including utilities, independent power producers, commercial and industrial companies, and residential customers.

The technique has proven to be very useful for finding positive surprises. Despite falling global prices for solar modules, Thakkar said he sees First Solar (FSLR) steadily building sales volumes at ASPs closer to what it has recently achieved. First Solar Inc said on Tuesday that renewable energy firm Longroad Energy has increased the orders for the company’s solar panels by 2 gigawatts (GW), taking Longroad’s total procurement to about 8 G… The First Solar stock recently publicized its Q2 earnings report on July 27th, 2023.

First Solar raised at BMO after post-analyst day pullback – msnNOW

First Solar raised at BMO after post-analyst day pullback.

Posted: Thu, 14 Sep 2023 16:27:12 GMT [source]

The reported earnings gave a positive surprise of 60.06% from the estimated earnings. Moreover, the reported revenue also gave a positive surprise by 12.25% from the estimated revenue. First Solar issued an update on its FY23 earnings guidance on Thursday, July, 27th. The company provided earnings per share (EPS) guidance of $7.00-$8.00 for the period, compared to the consensus estimate of $7.17.

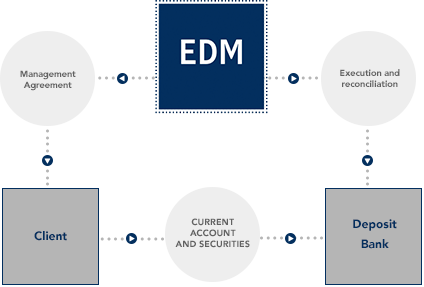

Trading & brokers

The company is scheduled to release its next quarterly earnings announcement on Thursday, October 26th 2023. The scores are based on the trading styles of Value, Growth, and Momentum. There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score. The Style Scores are a complementary set of indicators to use alongside the Zacks Rank. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer.

The company must continue to invest in research and development, innovation, and operational efficiency to stay ahead of the competition. First Solar’s leadership team comprises highly experienced professionals with diverse backgrounds and expertise. Mark Widmar is the Chief Executive Officer, leading the company’s strategic direction and operations. Widmar brings extensive experience in the renewable energy industry, having held various executive positions within First Solar since joining the company in 2006.

Countries across the globe are working tirelessly to increase the production and use of renewable energy and we will be able to see the results in the coming years. The government has given stimulus for green energy and there was a lot of excitement in the initial days. © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed.

MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation. The Zacks Industry Rank assigns a rating to each of the 265 X (Expanded) Industries based on their average Zacks Rank. Like it or not, higher interest rates hurt renewable energy developers and component producers. We’d like to share more about how we work and what drives our day-to-day business.

First Solar CEO: New facility plans driven by high demand and backlog

To see all exchange delays and terms of use please see Barchart’s disclaimer. First Solar benefits from its established global presence, strong partnerships with utilities and project developers, as well as a proven track record of delivering large-scale PV projects. These factors contribute to the company’s competitive positioning and provide a solid foundation for future growth. First Solar’s innovative approach and continuous investments in research and development have positioned the company as a technology leader in the industry. First Solar has consistently demonstrated strong financial performance over the past few years. The company’s profit margins remained robust, reflecting efficient operations and effective cost management.

More value-oriented stocks tend to represent financial services, utilities, and energy stocks. First Solar designs and manufactures solar photovoltaic panels, modules, and systems for use in utility-scale development projects. The company’s solar modules use cadmium telluride to convert sunlight into electricity.